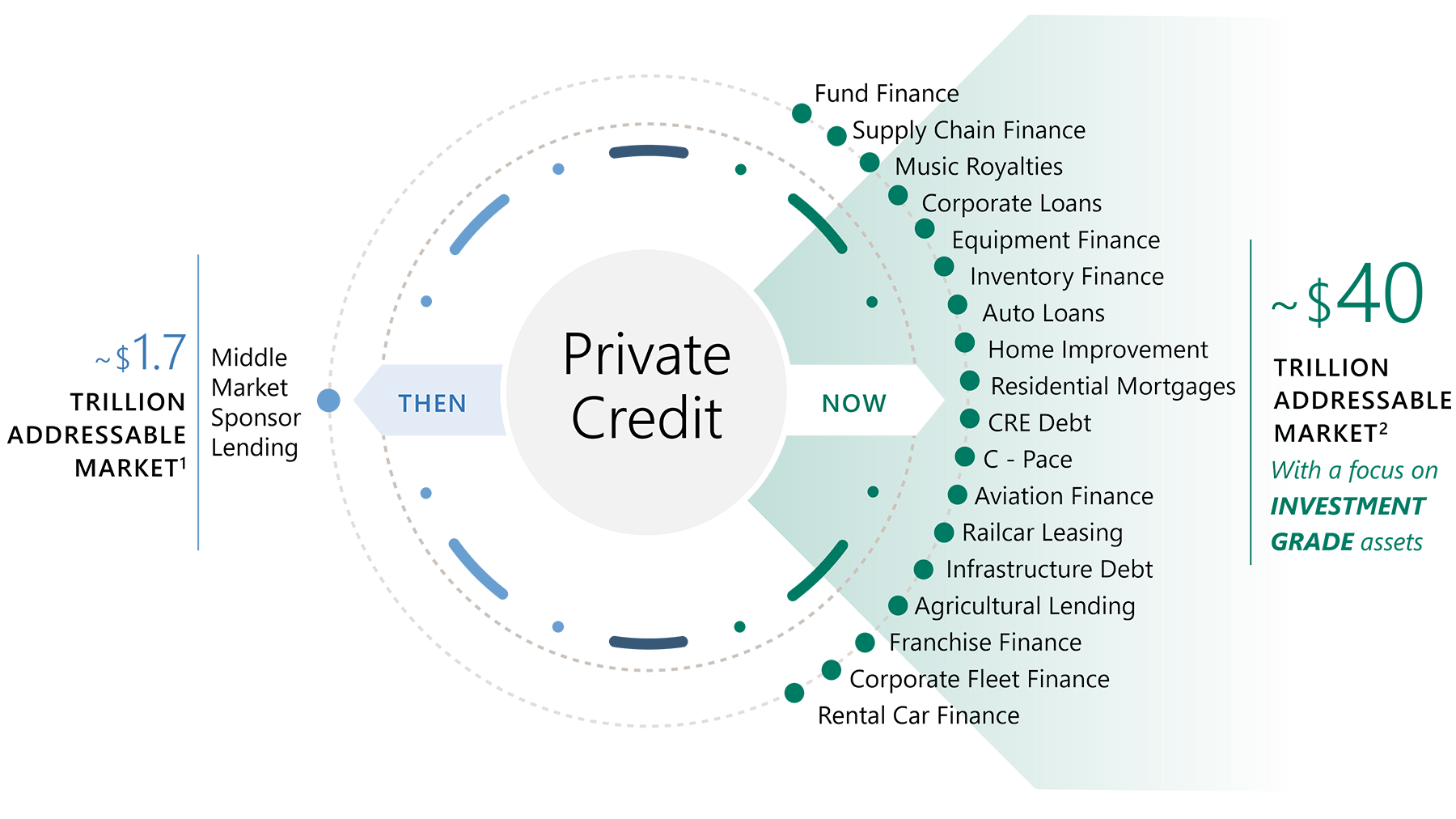

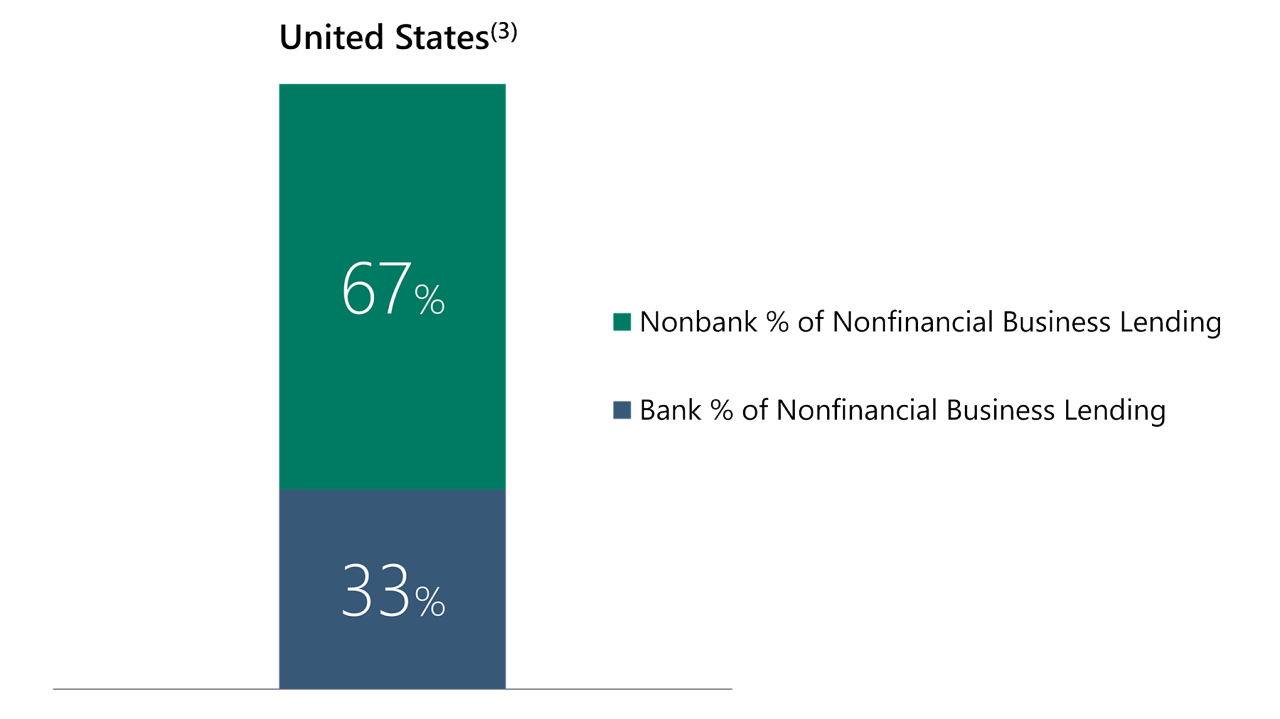

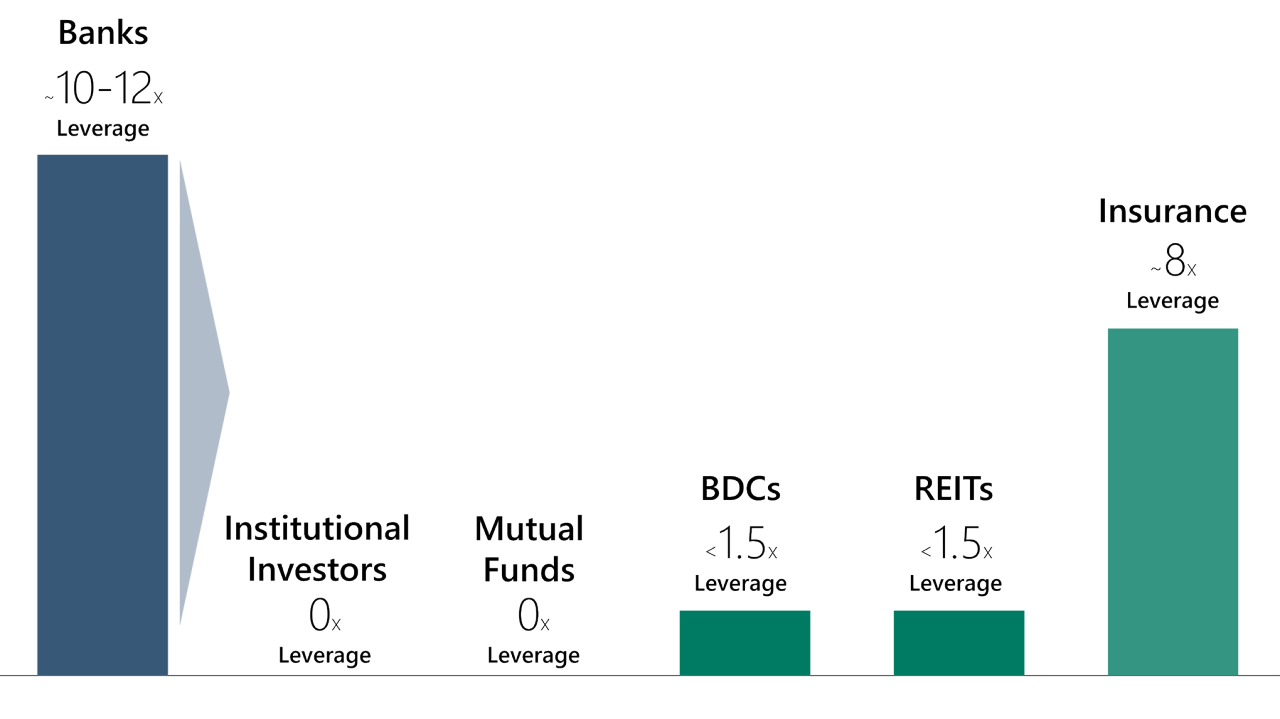

At Apollo, we view private credit as a $40 trillion market, a majority of which is investment grade. Non-traded – or “private” – corporate and consumer credit can be found on the balance sheets of banks as well as insurers, asset managers, pensions and many others in the investor marketplace. Private credit finances business growth and innovation, it supports household prosperity and it helps to fuel the real economy.

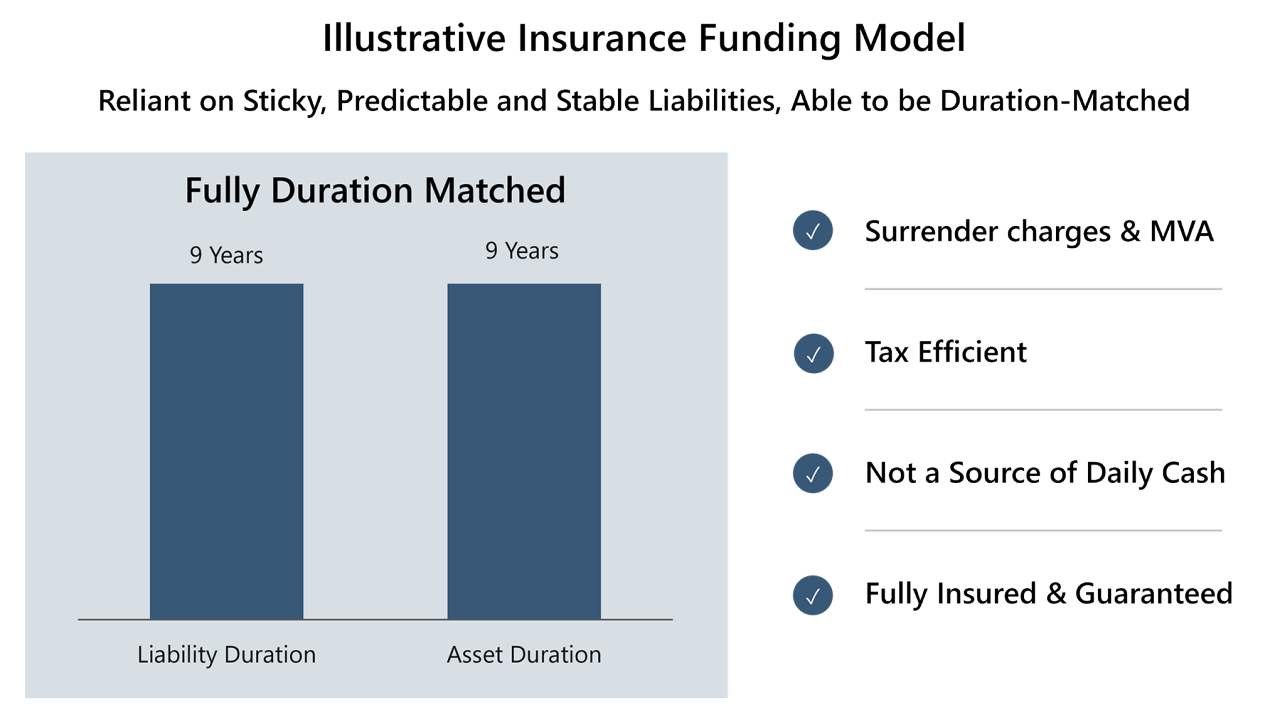

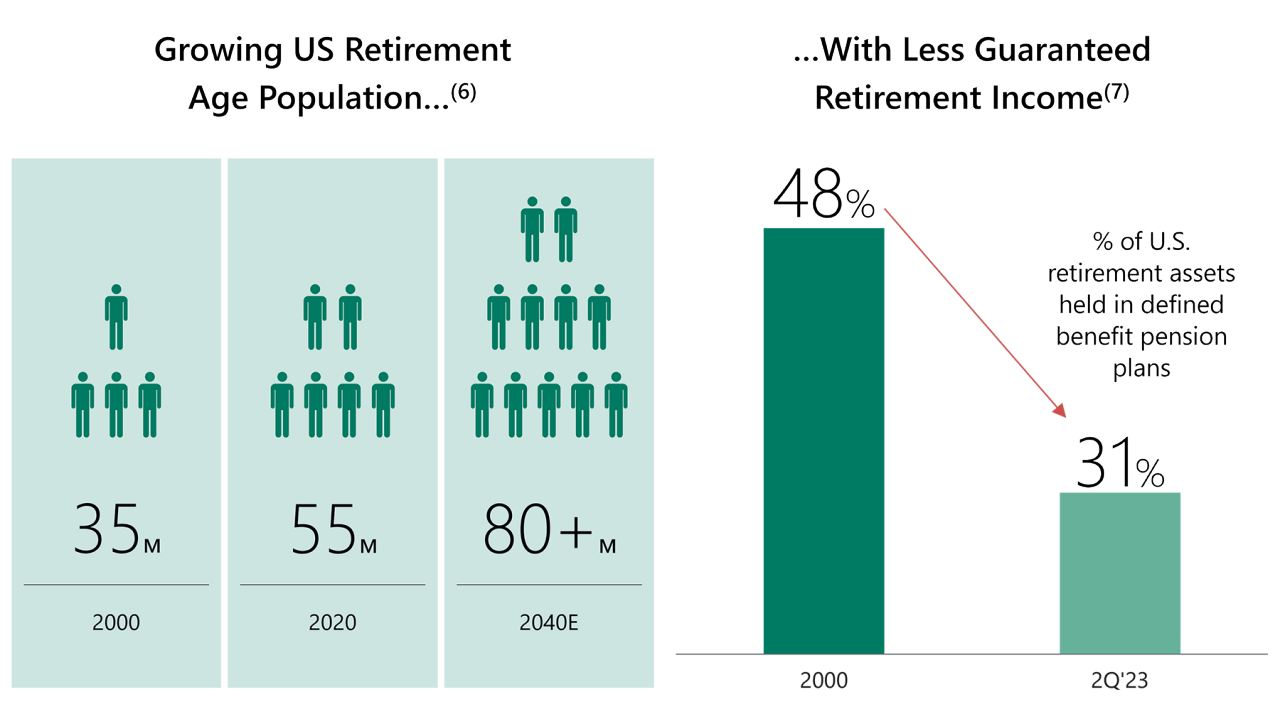

The vast majority of private credit is private investment-grade credit which helps to generate high-quality yield and retirement income for families and savers across the country. As the U.S. and much of the developed world navigate aging demographics and savings shortfalls, we believe private fixed income will continue to play an expanding role in supporting retirement security for millions of families.